What type of coverage does Commercial General Liability Insurance contain?

A commercial general liability insurance coverage products the insured with defense against a legitimate charges where the law products investment capital accidents as a possible therapy.

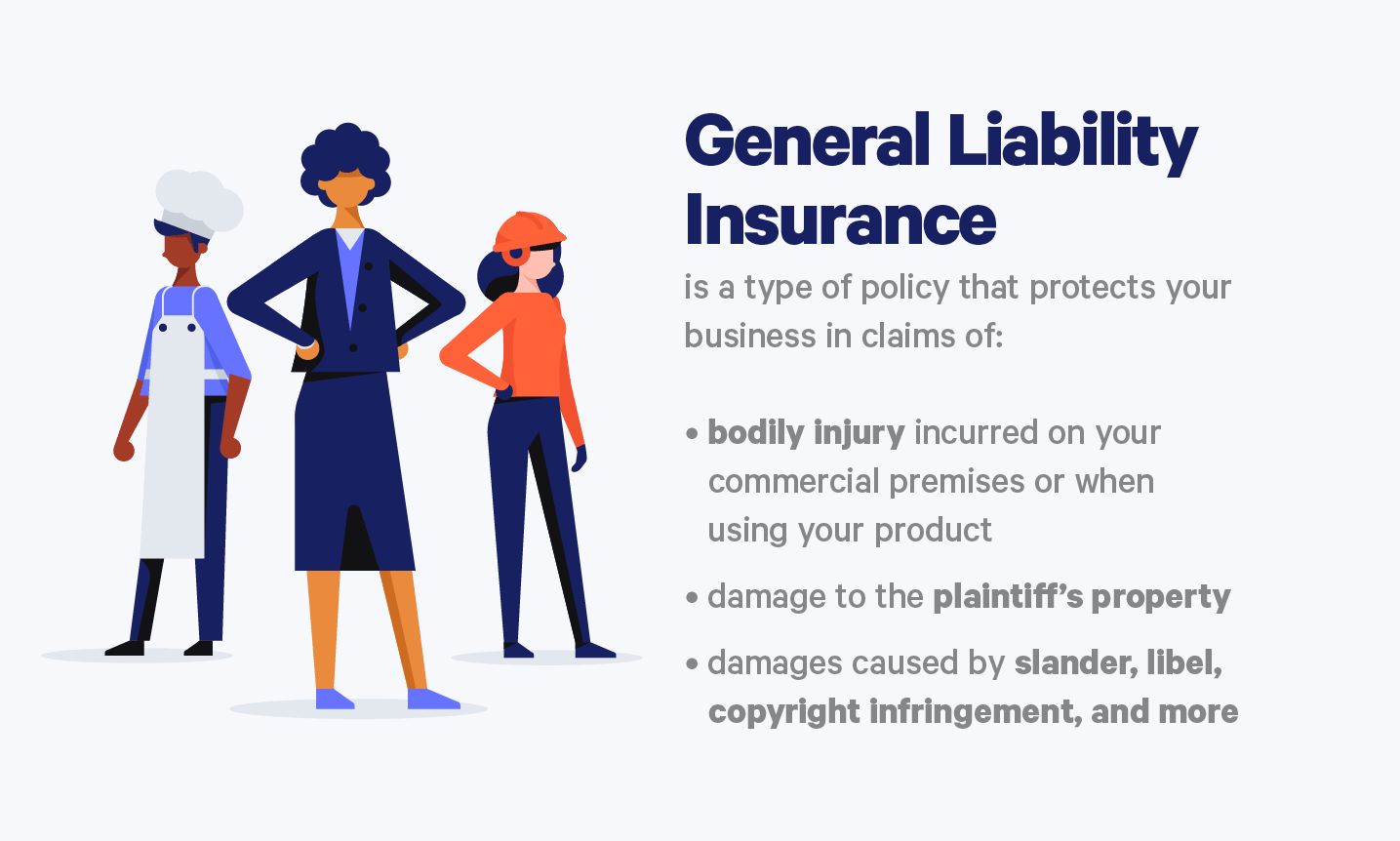

General liability insurance reimburses for your physical damage or house damage failures the policyholder may travel to third party up to the policy’s collection restrict. This insurance generally handles any lawful service fees and the courtroom expenses required to secure the state. Some of these obligations arise from:

•the correct and proper care of properties

•the conduct of your firm or procedure

•the make, allotment or offering of a product

•executed functions

•operate performed by individual building contractors or subcontractors

•liabilities are used by commitment

Businesses are intrinsically difficult. The good news is that a number of the threats may be included. Small business general liability insurance helps you to shield your enterprise against a variety of acknowledged and unfamiliar risks.

A number of the places within your enterprise which can be covered by small business general liability insurance contain:

•Property problems and actual physical injury: The property damage and bodily injuries assistance to safeguard your company against distinct company promises as well as promises alleging monetary loss as a result of actual injuries or property injury, coming from your merchandise or company procedures.

•Promotion problems: This safeguards your business from particular legal cases where other folks report that your organization has violated certain copyrights when promoting your items, services or results.

•Reputational problems: The reputational cause harm to handles your enterprise against lawsuits of adverse prosecution, improper detention, slander, defamation, unlawful removing and breach of security legal rights.

•Use to booked residence: This enables you to shield your small business from a number of legal cases which may come up in your business functions. This may be occasioned by lightning, flame or burst open.

•Health care charges: business general liability insurance will cover your small business against healthcare legal cases delivered forward when somebody becomes damage on the business property and desires medical treatment.

Proudly powered by WordPress. Theme by Infigo Software.